Director Briefing - May 19, 2025

- Director Briefing - May 19, 2025

- OWWL Library System Policy Updates

- Mediated Computer Purchasing has Resumed

- A Warm Welcome to Palmer at Attica

- Libby App Updates

- Know Your Rights Workshop with the New York Immigration Coalition | Friday, June 20 at 1 PM

- EAP Resources: June in Talkspace Go!

- Swank Movie License Survey

- Construction Aid

- Library of Congress Updates

- Ask the Lawyer from WNYLRC

- System Opinion: Reserve Funds in Public Libraries

- This Week in OSC Audits

OWWL Library System Policy Updates

Policy Updates

- State Aid for Library Construction Aid Policy – Merges the Construction Aid Policy and Reduced Match Eligibility Requirements Policy. Incudes program updates from State Education Law §273-a and New York Codes, Rules and Regulations Title 8 – Education §90.12.

- Social Media Policy – Minor updates to language.

- System and Member Library Relationship Policy – Added new policies and minor language updates.

New Policies

- Support for Trustee Education Requirements Policy – Establishes System-wide guidelines for supporting Trustee Education to Member Libraries.

- E-Rate Participation and Compliance Policy – Outlines the System and Member Library's responsibilities regarding the federal E-Rate program.

Mediated Computer Purchasing has Resumed

Bob let us know last week that mediated computer purchasing has resumed. For more information, see the order page here: https://docs.owwl.org/Members/MediatedComputerPurchasingA Warm Welcome to Palmer at Attica

This month, Palmer Perkins started as the new Director of Stevens Memorial Community Library in Attica. Congratulations, and welcome, Palmer!Libby App Updates

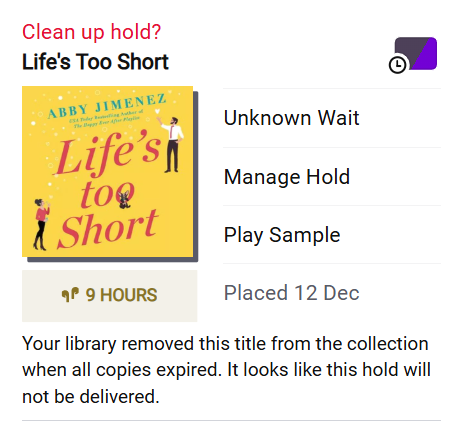

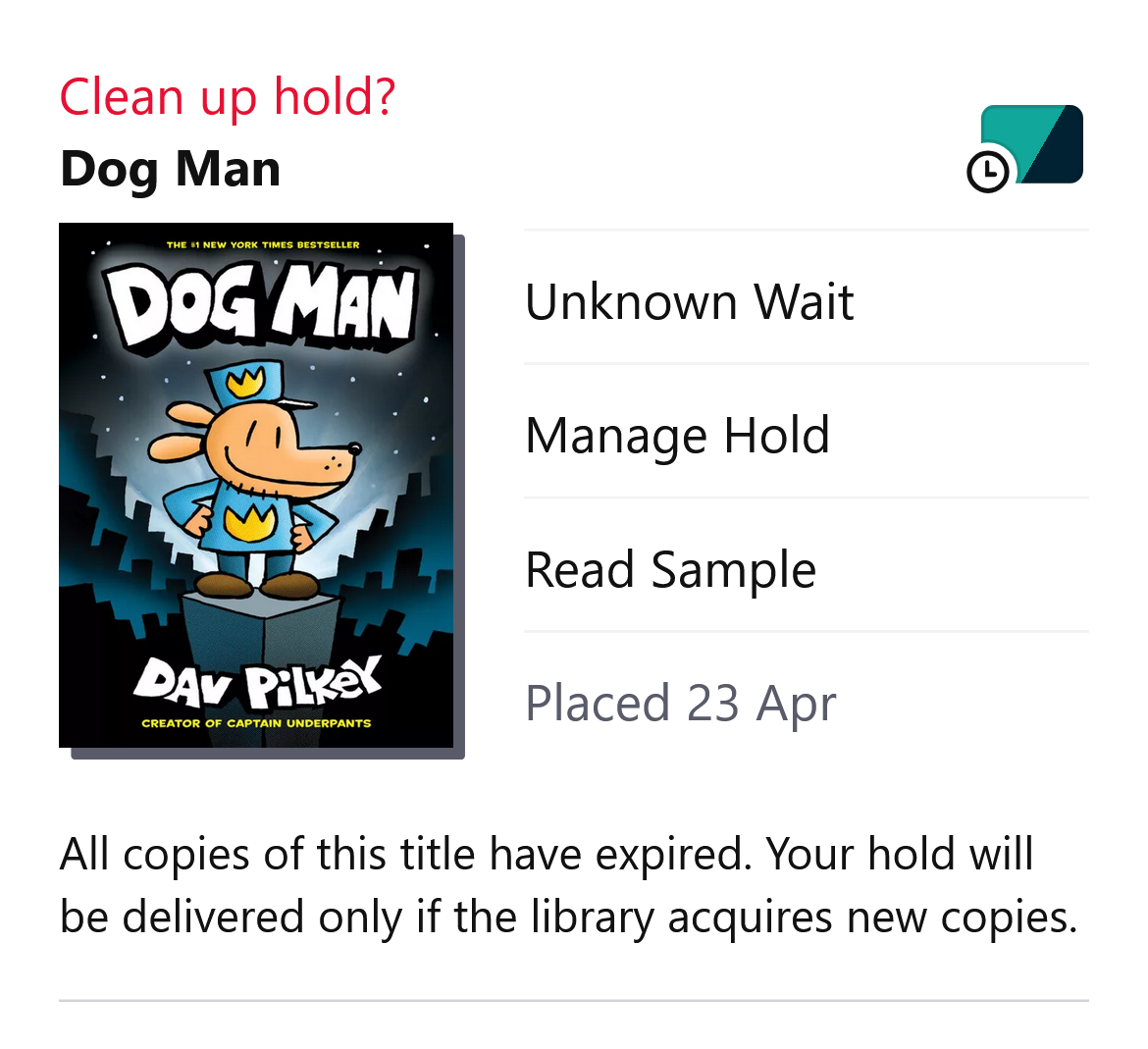

A few app improvements are coming to Libby, notably to the Holds screen. First, when a user has a title on hold that has expired or has been weeded, Libby will now display a Clean up hold? prompt and a description of why the title is no longer available.

Second, when a user borrows a hold, Libby will now provide the option to cancel other holds on that title that they may have at other libraries. This encourages users to free up space on library waitlists.

Second, when a user borrows a hold, Libby will now provide the option to cancel other holds on that title that they may have at other libraries. This encourages users to free up space on library waitlists.

Know Your Rights Workshop with the New York Immigration Coalition | Friday, June 20 at 1 PM

From DLD:Know Your Rights Workshop with the New York Immigration Coalition | Friday, June 20 from 1 PM to 3 PM | Register here Join us for a virtual Know Your Rights (KYR) presentation led by the New York Immigration Coalition (NYIC), a leading community partner organization dedicated to supporting immigrant communities across New York State. In this presentation, you will learn:This webinar will be recorded for later viewing by those unable to attend live; to receive the recording link, please register and it will be automatically sent to you.

- An overview of NYIC’s work and available services

- Information about different types of immigration and law enforcement agencies

- Your rights in various spaces (home, workplace, public areas, etc.)

- How to handle encounters with Immigration and Customs Enforcement (ICE), U.S. Border Patrol, and local police and sheriffs

- Tips on how to prepare in case of an emergency or enforcement action

- A guide to trusted resources and support available to immigrant communities

EAP Resources: June in Talkspace Go!

The EAP has shared this newsletter regarding their June classes coming up in the Talkspace Go app. Contact Kelly with any questions.Swank Movie License Survey

Thank you to the folks who have already responded to this. If you haven't yet, please find the Swank Movie License survey below:Following the Swank presentation at OWWLDAC, we wanted to gauge interest in reallocating Central Library resources to provide indoor Swank Movie Licensing to all member libraries. If you could complete the questionnaire linked below so we can better understand System-wide interest, current programs, attendance, and possible future programs, that would be great.If the survey doesn't appear for you above, visit the direct link here: https://forms.gle/yWVghUbmbhL9JFWr9 We'll send out a report on the results later this week. Thank you for your insights!

Construction Aid

Intent to Apply due Friday, May 30, 2025

Two weeks left to submit your Intent to Apply! All you need is a brief project description and a contractor’s quote showing the total cost. The minimum award is $2,500—and since libraries may be eligible to receive up to 90% in funding, smaller projects are absolutely welcome! Click here to complete the Intent to ApplyQuestions?

Let me or Kelly know if you have any questions, or need any support regarding Construction Aid.Library of Congress Updates

As you may know, Librarian of Congress Carla Hayden was fired by President Trump on May 8, and Shira Perlmutter, Register of Copyrights and Director of the U.S. Copyright Office, was fired May 10. The appointees to these positions have been denied entry to the Library of Congress until the Library receives direction from Congress. If you would like to read more, see below.- ALA praises service of Dr. Carla Hayden, decries "unjust dismissal" of Librarian of Congress (May 9, 2025)

- President Trump fires Librarian of Congress Carla Hayden (May 9, 2025)

- Trump fires head of Copyright Office after firing Librarian of Congress (May 11, 2025)

- The President has named a new Acting Librarian of Congress. It's his former defense lawyer. (May 12, 2025)

Ask the Lawyer from WNYLRC

Ask The Lawyer is an excellent resource out of the Western New York Library Resource Council. Here is a Recently Asked Question: School District Public Libraries Independently Calling for Budget Votes:Question: We are a school district public library. Can the school require the library to be part of its budget vote if the library desires to be separate from it? Answer: Each type of public library can be supported by a tax levy approved by the voters of a school district, but at school district public libraries, the voters also elect the library trustees. Unlike the other library types, the law gives school district public libraries a lot of authority to determine how these votes are conducted... Read more.

System Opinion: Reserve Funds in Public Libraries

To help address some recent questions about Reserve Funds, I’ve drafted the document linked below. Feel free to share it with your boards to support discussions around Reserve Fund planning. If you need further assistance—such as drafting establishing resolutions or developing policies—please don’t hesitate to reach out.Overview Reserve funds are critical tools that help public libraries manage cash flow, plan for future expenses, and respond to unexpected needs. Controlled by the library board of trustees, these funds—such as undesignated, capital, or special purpose reserves—must be clearly defined, properly authorized, and used only for their intended purposes. Establishing and managing reserve funds through clear policies and board action demonstrates strong financial stewardship and ensures the long-term stability of library services.Full document: Reserve Funds in Public Libraries.pdf

This Week in OSC Audits

| Audit | Key Findings | Takeaways for Libraries |

| Town of Perth - Conflict of Interest | A Board member was the sole proprietor of an automotive company that did business with the Town. Therefore, the Board member had a prohibited conflict of interest which means they did not follow New York State General Municipal Law (GML) Article 18 and the Town’s Code of Ethics. The prohibited interest occurred when the Board member’s business repaired a Town dump-truck and was paid $13,183 for the repair. The Board member with the prohibited conflict of interest, the Town Supervisor (Supervisor), and another Board member approved the $13,183 payment. According to the Board member with the conflict of interest, he approved the claim because two Board members refused to approve the claim due to their concerns with his prohibited conflict of interest. The Supervisor stated he approved the claim because the repair work was completed so the Town had an obligation to pay. Although the Supervisor, who is a member of the Town’s Board of Ethics, had concerns with the payment, he was unable to provide a reasonable explanation for why he did not bring this matter to the Town’s Board of Ethics. The remaining Board member approved the claim because the Supervisor had approved it. |

|

| Town of Perth - Supervisor's Records and Reports | The Supervisor did not maintain complete, accurate and timely accounting records or provide adequate financial reports to the Board. For example, as of March 31, 2024 the general fund was overstated by $584,018 and the highway fund was understated by $123,066. As a result, the Board lacked reliable records and reports to manage the Town’s financial operations. The Supervisor also did not:

The issues identified may have been detected had the Board annually audited the Supervisor’s records. |

|

| Village of Hudson Falls - Information Technology | The Village Board (Board) and officials did not establish adequate controls to safeguard IT systems or develop adequate IT policies or procedures. In addition, the Board did not develop and adopt an IT contingency plan to help minimize the risk of data loss or suffering a serious interruption of services, periodically test backups or provide IT security awareness training. As a result, Village officials cannot be assured that Village IT systems are secured and protected against unauthorized use, access and loss, and there is an increased risk that officials could lose important data and suffer a serious interruption in operations. For example, officials did not monitor employee Internet use. Although a June 2001 memo prohibited employees from using Village-owned computers for personal use, officials and employees were not aware of this memo. As a result, the seven employees’ Internet histories we reviewed identified that all seven employees used Village computers to access websites for personal use, such as shopping, social media, streaming platforms, entertainment, personal email and finances, food, and personal health and fitness. In addition, the Board paid two IT vendors for IT services totaling $31,333 during our audit period but did not enter into a written contract or service level agreement (SLA) with the IT vendors that described specific IT services to be provided. Officials did not monitor the services provided by one IT vendor to ensure all the services outlined in the annual invoice were provided. While the Village’s IT assets we examined were physically secured, the server and physical backups were not properly protected from water damage that occurred due to roof construction at the Village Hall. Weaknesses in policies, oversight and other internal controls increase the risk that hardware or software systems may be lost, damaged or compromised by unauthorized or inappropriate access and use. Sensitive IT control weaknesses were communicated confidentially to officials. |

|

| Town of Shelburne - Budgeting | The Board adopted unrealistic budgets. The budgets underestimated revenues and overestimated expenditures. In addition, officials appropriated fund balance to balance the budgets because purported revenues were not sufficient to fund operations. However, operating surpluses occurred which resulted in an unplanned increase in fund balance. Furthermore, the Board did not have written multiyear capital or financial plans or a written fund balance or reserve policy in place to guide the Board’s decisions regarding appropriate fund balance and reserve fund levels. As a result, more taxes may have been levied than were needed to fund the Town’s operations. During the audit period, the Board adopted budgets for the general fund TW, highway fund TW and highway fund TOV which underestimated revenues by approximately $3.4 million and appropriations by $1.9 million combined. Additionally, the Board appropriated $511,000 of fund balance which was not needed. More specifically, we determined the following:

|

|

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors. Ideas, requests, problems regarding OWWL Docs? Send feedback