Director Briefing - June 30, 2025

2025 RRLC Library of the Year: Williamson Public Library

Congratulations to Kim and everyone at Williamson Public Library for being selected as the 2025 RRLC Library of the Year!Books By Mail | Transitional Planning and Opportunities

Thank you to those who have already shared thoughts on our review of Books by Mail. We appreciate your insights as we consider next steps. Based on our conversations, we're exploring a transition model for interested libraries to pilot new or support existing alternative book delivery programs. Alternative book delivery programs could include outreach to homebound patrons and bulk lending to facilities (such as nursing homes, juvenile centers, and other residential facilities). Libraries taking the lead on programs like these allows services to be customized to meet specific community needs, and allows libraries to experiment with local outreach and cultivate community partnerships. We’re prepared to provide interested libraries with:- Existing program documentation and procedures;

- Patron contact information (with appropriate permissions);

- Vendor recommendations;

- Training, consultation, and support during implementation; and

- Funding from the System’s Outreach budget to offset initial costs and first-year operations.

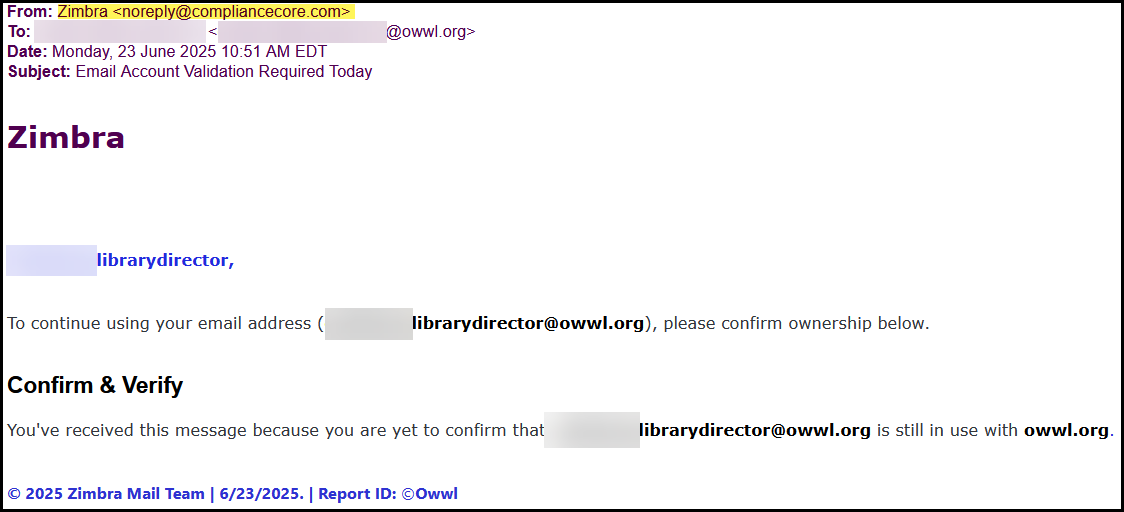

Phishing Emails Targeting Directors

Kelsy sent out a notice about phishing emails targeting directors. See the example below: As a reminder: We do not require confirmation or verification of ownership for any email user in the System. If you receive a similar message, please mark it as spam to help the Zimbra filters.

Feel free to forward any messages that seem odd to support @ owwl .org.

As a reminder: We do not require confirmation or verification of ownership for any email user in the System. If you receive a similar message, please mark it as spam to help the Zimbra filters.

Feel free to forward any messages that seem odd to support @ owwl .org.

Libby Updates

A new Libby update went live last week, with some new features:1. Content Controls. This feature allows users and families to configure what library content appears in their Libby app based on a title’s intended audience. Learn more about setting up Content Controls on Libby Help or as a video on the Resource Center .More information on Content Controls in Libby can be found in the recent OWWL Post .

2. Renaming the Tag button for titles to Save. Our goal is to make the value of regular tags instantly recognizable, especially for new users. On Libby Help, articles talk about “saving titles to tags” and similar language.

3. Accessibility statements for titles. These publisher-provided statements provide information about the accessibility of EPUB titles. They include conformance level, in-title navigation information, ways of reading, and more details. Accessibility statements are found on a title’s details screen.

This Week in OSC Audits

| Audit | Key Findings | Takeaways for Libraries |

|---|---|---|

| Town of Coxsackie – Supervisor’s Records and Reports | The Supervisor did not maintain complete, accurate and timely accounting records and reports. The Supervisor’s failure to maintain complete and accurate records or adequately provide monthly reporting to the Board reduced transparency and prevented it from properly monitoring financial operations and increased the risk that unauthorized or inappropriate transactions could occur and go undetected.

|

|

| Town of Alden – Town Supervisor | The former Supervisor did not always follow basic accounting principles by preparing or maintaining complete and accurate accounting records or providing sufficient financial reports to the Board. The Supervisor did not always adhere to basic internal controls that are designed to help ensure funds are safeguarded and accounted for. Because the Board did not receive adequate financial reporting, it was not aware of the Town’s financial status and, as a result, adopted unrealistic budgets. Without adequate accounting controls and accurate and timely financial information, the Supervisor and Board cannot make informed financial decisions. The former Supervisor did not:

In addition, the Town contracted with an accounting firm to audit the Supervisor’s records, help reconcile the bank accounts and correct accounting errors, but the Board and Supervisor did not implement corrective actions to address the accounting firm’s audit recommendations. |

|

| Town of Leicester – Financial Management | The Board did not effectively manage the Town’s fund balance and continued to unrealistically estimate revenues and appropriations in the adopted budgets. The Board did not correct the deficiencies noted in our prior audit (Budgeting and Financial Oversight (2015M-158), released November 2015), adopt written fund balance or reserve policies and did not properly establish reserves. In addition, the Board did not ensure it received up-to-date, accurate financial reports in a timely manner, which hindered its adoption of realistic budgets and multiyear financial or capital plans. As a result, officials maintained significant unrestricted fund balance in the town-wide (TW) and town-outside-village (TOV) funds that as of January 1, 2024 were sufficient to fund the entire 2024 budgeted appropriations. Also, the water fund had a deficit fund balance of $80,597. We project that the Town will have small operating surpluses in 2024, which will increase the significant fund balances. The Board continued to unrealistically estimate revenues and appropriations in the 2025 budget, which will likely result in operating surpluses that will further increase the significant fund balances in the general and highway TW and TOV funds. |

|

| Monroe No. 1 Board of Cooperative Educational Services – Credit Cards | BOCES officials did not ensure that all credit card charges were properly approved and supported. Therefore, it could not be determined whether all charges were for appropriate BOCES purposes. Additionally, officials did not ensure that credit card charges were reconciled to receipts in a timely manner and audited, as required, prior to payment. We reviewed 532 credit card charges totaling $138,238 and determined that 461 charges totaling $110,539 had one or more exceptions:

|

|

| Town of Bethlehem – Information Technology | The Town Board (Board) and officials did not develop and adopt an IT contingency plan or breach notification policy, periodically test data backups or provide employees with security awareness training. Sensitive IT control weaknesses were communicated confidentially to officials. As a result, the Town’s IT systems and its personal, private and sensitive information (PPSI)1 may be accessible to unauthorized use, access and loss. Officials also have minimal assurance that in the event of a disruption or disaster (e.g., a ransomware attack), employees and other responsible parties would be able to react quickly and effectively to help resume, restore or repair critical IT systems or data in a timely manner. Officials also did not monitor employee Internet use. Although the Town’s Computer and Internet Use Policy in the employee manual prohibits employees from using Town-owned computers for personal use, officials and employees were not in compliance with the policy. We reviewed Internet histories on eight Town employee computers, and all eight employees used the computers to access websites for personal use, such as news and advertising, personal online banking and finances, entertainment and travel, shopping, social media and streaming platforms. Weaknesses in policies, oversight and other internal controls increase the risk that hardware or software systems may be lost, damaged or compromised by unauthorized or inappropriate access and use. |

|

| Amani Public Charter School – Purchasing and Claims Approval | School officials did not procure goods and services in accordance with the established policy and procedures. As a result, there is no assurance that the purchases were made in the most prudent and economical manner without favoritism. Specifically, officials did not:

Officials also did not properly segregate procurement responsibilities. We identified that overlapping and conflicting responsibilities enabled two Directors to each control all aspects of the procurement process, including initiating a purchase request, approving the purchase, approving the invoice, and signing checks for payment. |

|

| Island Trees Union Free School District – Inventorying and Monitoring Capital Assets | District officials did not accurately and completely record and account for all capital assets we reviewed (i.e., machinery, vehicles, equipment and computers). Additionally, officials have not conducted a physical inventory to properly monitor and account for assets since 2011.Therefore, officials cannot assure taxpayers that all of the District’s capital assets are safe and accounted for. As a result, the District had significant risk for capital assets to be lost, stolen or misused.

|

|

| Avoca Central School District – Payroll | District officials generally paid employees’ salaries and wages accurately during the period July 1, 2022 through October 10, 2024. We reviewed 35 employees’ salaries and wage payments totaling $417,720 and determined that District officials generally1 paid employees’ salaries and wages accurately during the period. We also determined that District officials did not adequately segregate duties or establish mitigating controls over the payroll processing. Without adequate segregation of duties or mitigating controls over payroll processing, errors and irregularities could occur and go unnoticed. | |

| Avoca Central School District – Procurement | District officials did not always procure goods and services in accordance with the statutory requirements set forth in GML or with the District’s procurement policies and procedures. When officials do not solicit competition during the procurement of goods and services, taxpayers have less assurance that purchases are made in the most prudent and economical manner and without favoritism. District officials also did not develop procedures governing the procurement of goods and services not subject to New York State competitive bidding laws as required by the District’s procurement policy that was last approved by the Board in 2017. In addition, District officials did not aggregate purchases to determine whether certain procurements were subject to the competitive bidding set forth in GML. As a result, District officials did not always seek competition and:

Furthermore, officials did not ensure that purchases made using the “piggybacking” exception totaling $817,099 adhered to the competitive bidding exception set forth in GML Section 103(16). The piggybacking exception allows a district to benefit from the competitive process already undertaken by other local governments. |

HBR: Tip of the Day

Make Help More Helpful at Work Creating a culture of helping isn’t just about encouraging support—it’s about making sure the help given is actually, well, helpful. As a leader, your role is to shape how help is asked for, delivered, and appreciated. Here’s how. Push for clarity first. Guide your team to clearly define the problem before they ask for support. Encourage them to explain what success looks like and what kind of help they need. Use questions like “What’s blocking your progress?” or “What outcome are you aiming for?” to steer them toward precision. Normalize direct, specific requests. Vague requests waste time. Model clear communication by being direct when you need support—and encourage your team to do the same. Create psychological safety by praising clear asks, being transparent about your own needs, and framing collaboration as part of the job, not a favor. Institutionalize follow-through. Helping doesn’t end when support is offered. Make it standard practice to close the loop. Encourage team members to show teammates how their help made a difference and acknowledge their contributions. This not only builds trust but gives you insight into your employees’ strengths for future collaborations. Read more in the article, "Research: When Help Isn’t Helpful" by Colin M. Fisher et al.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors.

Copyright © by the contributing authors. All material on this collaboration platform is the property of the contributing authors. Ideas, requests, problems regarding OWWL Docs? Send feedback